Contra Account Definition + Journal Entry Examples

Content

Accounting is how we tell a story about an economic event or financial transaction, such as a purchase or a withdrawal of money, for example. Periodic financial statements report the impact of the story and are used by leaders of a firm or industry to analyze performance, plan, and respond. The contra account offsets the parent account to reveal the remaining net amount of non-current assets. When a company gives a discount to customers in an effort to convince them to buy its goods or services, it is recorded in the discount on sales account. The sales allowance shows the discounts given to customers when returning the product. This is done to entice customers to keep products instead of returning them.

What are the different types of contra accounts?

«There are 4 main types of contra accounts:

– Contra Asset Account

– Contra Liability Account

– Contra Equity Account

– Contra Revenue Account»

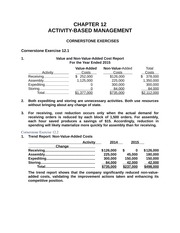

Conta revenue account examples include sales returns, sales allowance, and discounts. Learn about the meaning of contra accounts, how and why they are used, and how to account for balances with them. Contra liability accounts such as discount on bonds payable and discount on notes payable usually carry debit balances.

Examples of Contra Accounts

There are different types of Contra Accounts and the most common are contra asset, contra liability, contra equity and contra revenue accounts. A contra asset is paired with an asset account to reduce the value of the account without changing the historical value of the asset. Examples of contra assets include Accumulated Depreciation and Allowance for Doubtful Accounts.

Assets appear with a positive balance because they are recorded as a debit to the account. A negative balance, or credit entry, in an asset account, usually indicates a mistake or is accompanied by an explanation. Contra assets are a rare exception as they are recorded as a credit balance and appear as a negative number. A debit entry in a contra asset account is unnatural and most likely indicates an incorrect journal entry. To illustrate, let’s use the contra asset account Allowance for Doubtful Accounts. Since it is a contra asset account, this allowance account must have a credit balance .

Company

Most accounts receivable would just be the time between purchase and credit card settlement. If you’re valuing a low-growth company based on its equipment assets, you want to use the net value to be conservative. On the other hand, if you’re looking at a high-flying growth stock that reports new revenue growth records each quarter but has a massive allowance for doubtful accounts, there may be problems ahead. Outstanding SharesOutstanding shares are the stocks available with the company’s shareholders at a given point of time after excluding the shares that the entity had repurchased. It is shown as a part of the owner’s equity in the liability side of the company’s balance sheet. These accounts can be listed based on the respective asset, liability, or equity account to reduce their original balance. When accounting for assets, the difference between the asset’s account balance and the contra account balance is referred to as the book value.

3 tips for marketing veterinary dental services – DVM 360

3 tips for marketing veterinary dental services.

Posted: Wed, 18 Jan 2023 08:00:00 GMT [source]

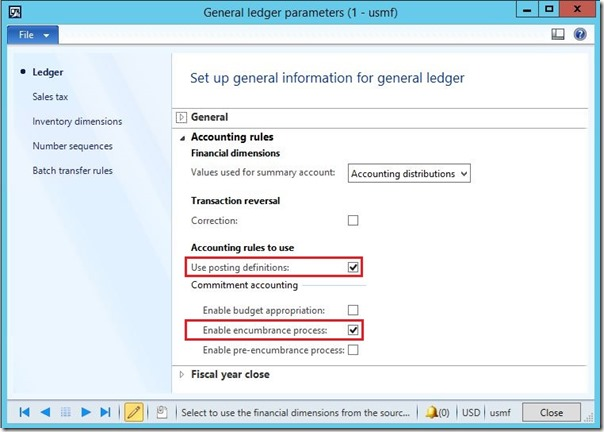

They can present more information about the assets and liabilities of the company. Such information includes the purchase cost of an asset , the amount of depreciation written off for that asset, etc. Whenever the balance of an account needs to be reduced in a company’s ledger, it is not always applicable to credit the account if it is an asset or debit the account if it is a liability. To record a revenue contra account, the company must be able to determine how much the contra account is.

Contra Account in Business Accounting

Companies bury them in the footnotes and often don’t break out the actual calculation. Still, it is important when possible to consider how the net accounts are calculated and be wary of companies that are reporting a ton of bad debts. The contra equity account treasury stock is reported right on the balance sheet.

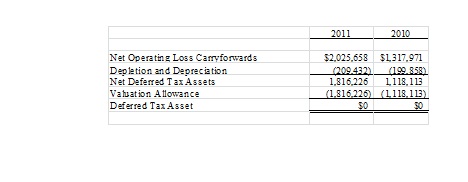

Accumulated depletion is the counterpart of natural resource assets. Sales Discounts – Amount of discount given to customers who are usually able to pay earlier than the due date of an invoice.

Allowance for Doubtful Accounts

Contra accounts are usually linked to specific accounts on thebalance sheetand are reported as subtractions from these accounts. In other words, contra accounts are used to reduce normal accounts on the balance sheet. Revenue AccountRevenue accounts are those that report the business’s income and thus have credit balances.

- Hence, the book value of the liability will be the credit balance of the liability account minus the debit balance of its contra liability counterpart.

- Without this account, the user may not know about the adjustments made to the value of machinery.

- Accumulated depreciation and allowance for doubtful accounts are the main contra asset accounts.

- When revenue increases it is credited and when decreases it is debited.

- This sheriff sales from 1817 shows that the person recording the financial data recorded the contra accounts as negatives and to the side of the regular accounts.

- Due to this, they have to recognize accumulated depreciation, as the sum of depreciation expenses recognized over the life of an asset.

- A major example of a contra account is the accumulated depreciation.

This is done by separating the decreases that have occurred in the contra account from the original transaction amount. This allows the reader to see both the current and historical book What Other Types of Contra Accounts Are Recorded on the Balance Sheet? values for a particular asset or liability. The amount in the accumulated depreciation account is deducted from the assets of a company, such as buildings, vehicles and equipment.

This type of account could be called the allowance for doubtful accounts or bad debt reserve. The balance in the allowance for doubtful accounts represents the dollar amount of the current accounts receivable balance that is expected https://online-accounting.net/ to be uncollectible. A machine purchased for $15,000 will show up on the balance sheet as Property, Plant and Equipment for $15,000. Over the years the machine decreases in value by the amount of depreciation expense.

- Sales discount accounts record the discounts provided to customers when they purchase in bulk or make early payments.

- In conclusion, accumulated depreciation is not treated as an asset or liability on the statement of condition, rather it is treated as a type of contra account.

- The accumulated depreciation account appears on the balance sheet as a credit and is a reduction from the total amount listed for fixed assets.

- Companies like to depreciate assets as quickly as possible to get the tax savings, so the balance sheet may not state the true value of fixed assets.

In case the CA account is not listed in the balance sheet, it must be listed in the footnotes of the financial statement for the users to be informed. Note that in accounting, the term «book value» is also used interchangeably with net value. Therefore, the book value of an asset in the books is equal to its historical cost minus the related amount of contra asset in the balance sheet . A contra asset account is an account in the balance sheet that offsets the balance of a regular asset account. Maintaining a contra account is important as it provides more clarity on the dealings of a company.